Digital Wallet

The problem

Proposed Solution Digital Wallet Launch

maya.ai Pay integrates with all systems including Core Banking Platform, Credit Scoring Engine, Enterprise Applications and Country Telcos Indicative list of partners Presentation Layer CRM ERP Core Switch Maya.ai Pay Merchant Core Services App Core Banking LMS AML Savings Loans Onboarding Credit A A Validation Cryptocurrency Wallet P Insurance Wallet Core Switch P Customer I App I Biometric Credit Check Self Service Identity Call Insurance s Authentication s Validation & KYC Centre Products Identity Bill Payments Validation OCR AI/ML powered by Admin and Telcos MDM Others Reporting Data as a Service Portal + Recommendation as a Service Entertainment E-commerce Gaming

Proposed Solution Digital Wallet Growth

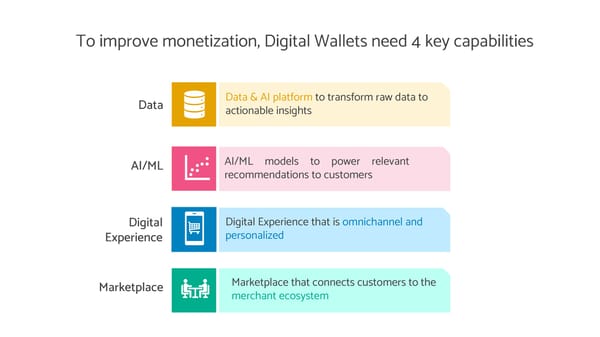

To improve monetization, Digital Wallets need 4 key capabilities Data Data & AI platform to transform raw data to actionable insights AI/ML AI/ML models to power relevant recommendationstocustomers Digital Digital Experience that is omnichannel and Experience personalized Marketplace Marketplace that connects customers to the merchant ecosystem

Differentiation

The only full stack solution in the market; adds value across data, algos, apps, marketplace layers Pre-built data models for customer and merchant wallet Proprietary algos to drive customer and merchant engagement App front-end can be customized, supports multiple languages Quickly add capabilities through integrations from partners

KPIs Impacted

maya.ai digital wallet solution will impact the following metrics • Increase # customers onboarded • Increase merchants opting for financial products • Increase # merchants onboarded • Increase customers opting for financial products • Increase customer activation • Increase merchant engagement • Increase dormant customer reactivation • Reduce customer churn • Increase portfolio spends • Reduce merchant churn

Solution components

maya.ai enables Enterprises build the Digital Wallet Ecosystem Source Systems maya.ai Data As a Service (DaaS) creates the data Agent App CRM ERP infrastructure (data lake house) for the bank and integrates with all back-end source systems Core Banking AML Services KYC / Marketplace as a Service (MaaS) provides supply Identity Telecom of merchant and offer inventory - dining, apparel, travel, Merchant App Validation retail, etc Crypto Credit scoring Recommendation as a Service (RaaS) matches Customer App customer's preferences based on past transactions and Wallet creates personalized offer recommendations for every customer Customer Experience As a Service (CXaaS) provides a Admin and front-end to show the recommendations which can be integrated Reporting into the digital wallet Portal

Loan approval and disbursal journey for customer on maya Pay M1 Customer Registration Customer enters Unique Identification Number & Phone Number ID verification done by integrating with national database Customer keys in Account created Customer views financial information to complete for customer products like Device the account setup Loans & Microfinance KYC and credit Customer applies checks before for loan paying an Customer views pricing issuing loans initial fee plans for device loan Loan is approved

Loan repayment journey of customer on maya Pay Customer can view due and total outstanding loan amount All details of Customer given the loan taken option to pay daily, is displayed weekly, monthly Customer can repay in custom amounts Payment received

Deployment Options Default Components Details Cloud AWS or Azure Transaction Data Extraction from source systems Campaign Integration Across Email, SMS, Push notification API Integration Across Website, Mobile App *Customizations are possible but will impact cost & timelines

White labelling and customizations The ‘Launch Digital Wallet’ solution is available for white labelling and additional customizations • Branding and logos: Apply brand names, colours, and logos according to your style guide • UI: Choose from a set of standard layouts and cards, or customize your own • Typography: Font selection • Product writing: Product names, list names, and more • Privacy Policy and Terms & Conditions: Align with internal privacy policies and terms & conditions

Required Data

maya.ai needs the following data sets for driving digital wallet growth Customers Transactions across Card Products Offers Digital Data Service Requests * customer_id (masked) banking products * customer_id (masked) offer_id user_IP customer_id (masked) mar_status tran_id card_id (masked) offer_name customer_id (masked) request date gender tran_datetime cr_lim_group offer_start_date Session Date request_id nationality tran_amount card_product Request_type tran_description offer_end_date Session Start Time Request_status cr_lim card_type card_status merchant_name Session End Time Resolved_date email_flag issuer_type create_date Merchant_description CookieID dnd_flag merchant_code primary_secondary_flag product_name Product ID interacted with sms_flag merchant_name offer_type Interaction Type cc_type merchant_city salary_bin merchant_country Merchants offer_category customer_segment customer_id (masked) merchant_id offer_redemptioncode age customer_segment merchant_name offer_locations Campaigns customer_from product_id merchant_category offer_link customer_id (masked) zipcode/City product_category address offer_t&Cs campaign date points_balance mcc_code offer_img_urls campaign_id tran_terminal_id contact_no channel tran_geocode zipcode deliver_date card_id (masked) geocode open_date click_date points_earned mcc_code view_date points_used settlement_date merchant_tags tran_type tran_code tran_ecom_flag Mandatory Optional *Real time data needed

Process flow – Data Transfer Mechanismswith Crayon Raw data transfer from Enterprise to Crayon Cloud Processed recommendation data transfer from Crayon SFTP • Enterprise can extract data from their DB and Cloud to Enterprise transfer via SFTP Email & SMS • Crayon can deliver batch files via SFTP • Crayon can help automate this Campaigns • Crayon can expose an API that the Enterprise can call from within their environment API • If Enterprise has built an API to transfer data, • Crayon can integrate with the Email and/or Crayon can call it SMS execution engine and pass the data directly to that system Engage App, • One time integration of Widget or API with Integration to • Crayon can integrate with Enterprise’s data Widget & API Enterprise’s digital asset. Data lake lake and pull the data. • Once this is done data exchange will be real- • Enterprise will need to give Crayon time and continuous i.e. no manual permission to access the data lake and write intervention needed after one-time the data extraction jobs integration Integration • Crayon can integrate with the Enterprise’s Integration • Crayon can integrate with the Enterprise’s with event streaming platform and add workflows to with channels streaming platform and add its model topics platform ingest real-time events across transaction such as for real-time event-driven recommendations (Kafka, processing systems and native applications SMTPs, • Enterprise will need to give Crayon Kinesis, etc.) • Enterprise will need to give Crayon execution permission to access the streaming platform permission to access the streaming platform systems and add workflows for integrating model and add workflows for bringing in events topics with real-time events

How Enterprises anonymize/mask data before sharing it with Crayon Transaction Data Customer ID Merchant Name Card Number Date Amount Enterprise has PII data 171127 The Educated Pot 4850909284846029 25-03-2021 35.08 in its data lake 171128 The Hidden Chariot 9840203948230982 25-03-2021 3.91 171126 The Thunder Plum 8347104982344983 25-03-2021 4.84 171125 The Smelly Growth 1458710875243090 25-03-2021 23.95 Customer Id Mapping Card Number Mapping Enterprise creates Customer ID Masked Customer ID Card Number Masked Card Number anonymized data using 171125 b09c16fcd90889cfdaa59ac9ac76894e 1458710875243090 75284494dd043356b727de882fea084a Hashing Algorithms 171126 bcb39d95c667faa134415186c0e8fbdf 8347104982344983 b4991fc9706f9a71dd40cd1856822b22 (For example, using MD5) 171127 8e69f6b56f0905a684f20c8ad4f2e702 4850909284846029 dc0a6d660cdd3216c546420095130ce7 171128 043f134b2b9469d5e08d8780047bab41 9840203948230982 a2d9dc79b1a280ee01e921af26b492be These mapping tables can be stored in the Enterprise’s data lake Masked Transaction Data Masked Customer ID Merchant Name Masked Card Number Date Amount Enterprise shares 8e69f6b56f0905a684f20c8ad4f2e702 The Educated Pot dc0a6d660cdd3216c546420095130ce7 25-03-2021 35.08 anonymized data (No 043f134b2b9469d5e08d8780047bab41 The Hidden Chariot a2d9dc79b1a280ee01e921af26b492be 25-03-2021 3.91 PII) with Crayon bcb39d95c667faa134415186c0e8fbdf The Thunder Plum b4991fc9706f9a71dd40cd1856822b22 25-03-2021 4.84 b09c16fcd90889cfdaa59ac9ac76894e The Smelly Growth 75284494dd043356b727de882fea084a 25-03-2021 23.95 Crayon can enable the Enterprise to mask the data

Technical Architecture

maya.ai – solution architecture Open API. Easy Configuration. Plug n Play Customer Experience as a Service Retail Bazaar Trigger & Context based recos B2B predictive marketplace Consumer Merchant Enterprise Mobile lifestyle apps apps assets banking apps Category Experiences incl. Travel P2P & P2M payments Upsell/x-sell recommendations (web/mobile) Dashboards Wallets Custom apps Use cases & Territory Management Customer loyalty management +++ Interfaces experiences Cognitive BIM API Partner Vendor Inventory Agent Taste API Engage Results Lists API Payments Merchants Cashback APIs API API API API API API API API API +++ Territory Search Product Destinatio Insights Genome Interactio User API Itinerary Affiliate Offers API Fulfilment API API API n API API API n API API API API Data as a Service Recommendation as a Service Marketplace as a Service API extraction User-centric data lake to power automation experience-oriented solutions Patented TasteGraph Patented Choice AI Global Products Global Enterprise Algorithms algorithms Repository Repository Entity standardization & disambiguation Operations & business-centric Global Merchant Distributed data data lake to deliver 50+ SOTA & out-of-box algorithms Repository movement optimization-oriented solutions rd rd Enterprise Transaction CRM 3 Party 3 Party System Merchant Data Data Partner Enrichment Integrations data Systems Systems Integrations Data Offer Merchant Core Repository Details Communication +++ 3rd party APIs +++ banking E-Wallet Identity Systems system platform verification Infrastructure & Integrations

Solution deployment on AWS

Solution deployment on Azure

Security

Deployment ensures maximum security for enterprise data Crayon follows Defense in Depth approach which includes ✓ Compliant to regulatory standards - CIS, SOC TSP, PCI DSS (Azure) and ISO 27001 (Crayon). ✓ Components hosted in private zone behind Azure Firewall. ✓ Encryption of Data at Rest & Transit across components. ✓ Web Application Firewall (WAF) with OWASP Standard protection for externally exposed endpoints. ✓ Protection against malwares by enterprise standard Trend Micro Deep Security Tool. ✓ RegularVulnerability Scanning by third party auditors (Qualys) ✓ Penetration Testing of external endpoints at regular intervals. ✓ Real time monitoring and Incident Alerting mechanism

Support Needed

Enterprise to provide minimal support to aid deployment Category Collaborative Support • Share anonymized transaction data (No PII) of complete retail banking customer base Data with 12 months transaction history • Setup regular data refresh cadence (daily/weekly/monthly) People • Dedicated single point of contact for successful project execution • Applicable approvals/sign offs to be provided in the agreed timelines in order to proceed Approvals with every phase of the project Campaigns • Timely launch of campaigns for driving traffic to storefront

Commercial Model

Commercial Model Module Base Annual Fee* AnnualSubscription** Professional Services*** Data as a Service $ A N/A At actuals for any custom requirements (DaaS) Customer Experience as $ B N/A At actuals for custom requirements aService (country specific requirements, integrations to (CXaaS) 3rd party platforms, Data enrichment, UX modifications etc) Marketplace as a service $ C Tiered Pricing based on merchants (MaaS) onboardedon the platforms Recommendation as a Service $ D Tiered Pricing based on customer (RaaS) baseonboarded on the platforms Affiliate Revenue Split To Be Agreed BetweenEnterprise and Crayon Data *Base Annual Fee • will be the minimum annual price for the modules that are part of the proposal. • This caters or allows Enterprise to onboard up to 100K customers. • This is applicable to every new instance of the platform that will be set up for Enterprise. ** Yearly Subscription • Based on tiered pricing and will be in effect once Enterprise onboards more than 100K customers. *** Professional Services • Will be estimated based on scope of work and charged at actuals for all custom services requested including but not limited to integrations to 3rd party platforms, country specific requirements, compliance related requirements etc.